What is the number one thing a startup founder can do to ensure a seed stage investment?

Sell category potential.

Investors must believe they are getting in early, in an emerging market category.

Savvy investors seek potential, not performance.

They identify companies leveraging technology to create and dominate new market categories that show promise for significant growth.

Because elite tech investors know two things that others don’t:

First, the category makes the company. There is no such thing as a legendary company (brand) that does not dominate it’s niche.

And second, the technology business is a winner-take-all game, where companies that dominate specific markets in tech, such as Google, Facebook and Salesforce, often gain of 76% of the total value in the category.

“Smart investment choices require understanding the potential size and importance of the market category. We seek mission-driven founders who can build a great company and category at the same time,” Sequoia Capital partner Jim Goetz says.

He should know.

His early investment in WhatsApp turned into the $19 billion transactions heard around the world.

Facebook didn’t just buy WhatsApp’s revenue, technology or its 450 million active users. Facebook wanted WhatsApp’s leading position in a strategic, massively growing new market called mobile messaging. The transaction was reported to be the largest acquisition in venture history.

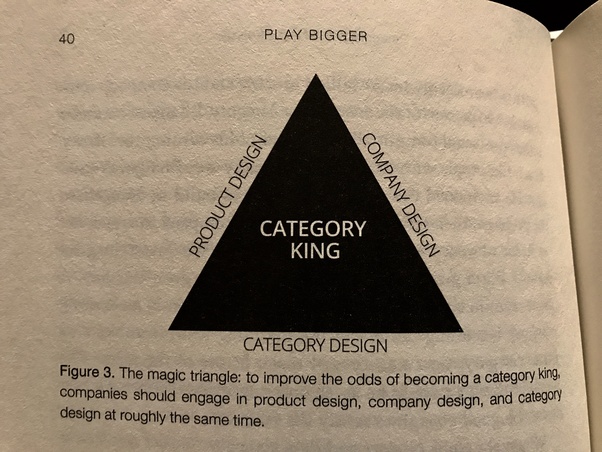

To gain investments from the greatest startup investors, you must get them to believe that you can create a legendary product, company AND category — while executing to earn 76% of the total value in the space.